And that one thing is to AVOID becoming a MORTY. Hopefully, you’ll understand what I mean by this by the end of this post. But if you’ve seen the series Rick and Morty (check it out if you haven’t, it’s fun), you know Morty is the naive guy who generally ends up getting taken advantage of.

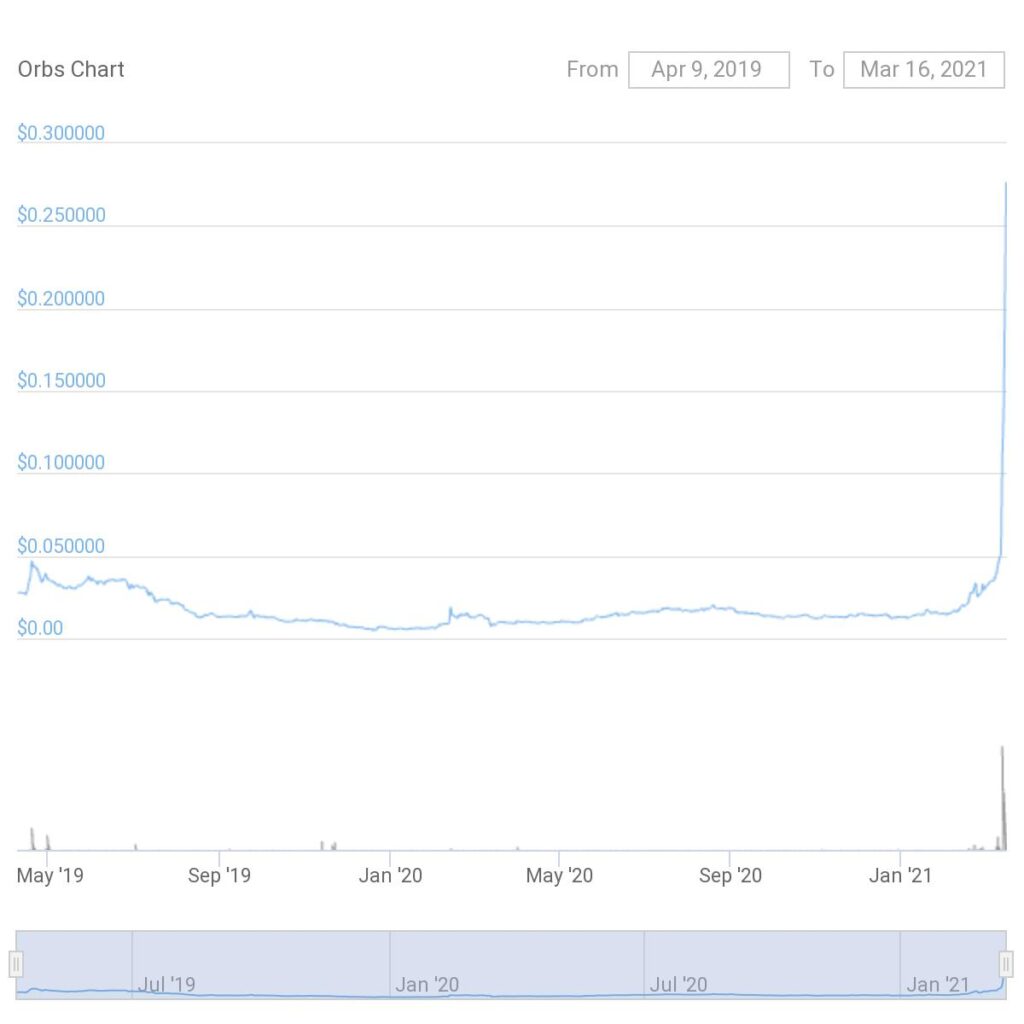

Coming back, in another post I spoke of a few things you ought to know about while buying a cryptocurrency. But there’s one thing I can’t stress enough – avoid getting trapped in FOMO. As I write this, it is one of those times when euphoria dominates the markets. Coins are making insane moves. Here’s one I just came across earlier this evening – ORBS (have absolutely no idea what this project does)

So in March this year, this coin has moved from 2 cents to the current price of 27 cents. Basically, a $100 investment on the 1st of March would currently be worth around $1300. And this is by no means “a one-off”. It’s happening all the time. This is why there’s a need to be careful while trading or investing (I use these interchangeably here but please know there’s a big big difference).

And there’s something psychological here. It’s the FEAR OF MISSING OUT (FOMO). FOMO is not exclusive to crypto but in fact traverses different areas of life. Check out this example, and I’m borrowing here from a King University research paper:

It’s getting later in the evening, but you’re feeling restless. You want to wind down after a long day by casually browsing your Instagram or Facebook feed when you’re overcome by an all-too-familiar sensation. You see a friend has uploaded pictures of an elaborate dinner at a Hibachi grill. Another has recorded a beach sunset saturated with beautiful pastels. As you scroll through countless stories of your friends doing fun and impressive things, your restlessness continues to build and build.

The emotions are hard to describe, but it feels like a weird combination of exclusion, self-loathing, and envy. It’s a strange and utterly empty feeling, and it’s becoming increasingly more common among social media users. The social media phenomenon is known as the fear of missing out, or FOMO.

Back to crypto. So if you’re one on Twitter, you’re probably seeing every second or third tweet screaming a BUY.

“Buy IDLE FINANCE NOW. 100 x coming up”

“Buy PAID. Now are never”

“Buy ERN or miss out forever”

I do not have any specific advice on these. Only used them as an example. With tweets and messages like these, it’s very difficult to stay on course or stay disciplined in trading. The FOMO is heavy and you can slip easily. Happens to everyone. All you can do is take some caution.

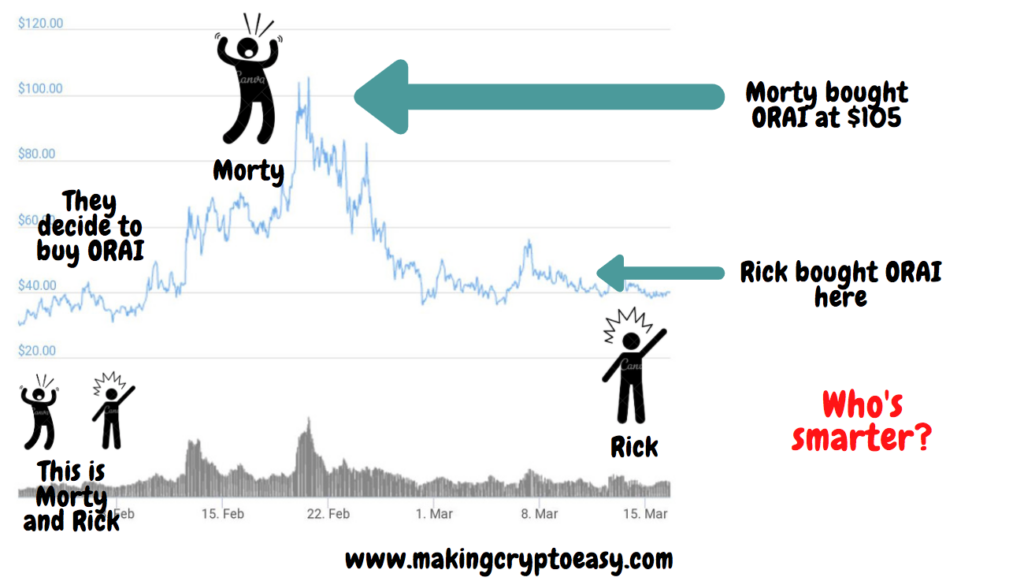

Here’s a picture I shared this afternoon on Twitter. It’s a chart of $ORAI providing a perspective of FOMO using two characters Rick and Morty.

Morty ended up buying Orai at $105. The top. Orai released its mainnet end of February and the hype surrounding the project was at its peak. (There were screams of buying on Twitter – I can’t find the tweets from then – but I remember seeing buy calls, left right and center). Morty was a victim of that FOMO. He gave in to that FOMO. He ignored the fact that ORAI had run up 550% in the past month and instead had his eyes locked on the 100X (100 times price target) he read about in some tweet.

Rick chose to wait. He saw the event play out (the launch of the mainnet). He’s heard of something called: Buy the rumour, Sell the news. It played out and ORAI came down to around the current $50 to $40 range. He began buying here.

So this is why I began by saying – AVOID becoming a Morty.

Now obviously this does play out exactly like this always. It happened in the case of ORAI, hence the example. Going back to the earlier chart of ORBS – is this the end of the up move? I don’t know. Crazier things have happened in crypto. It can continue moving upwards. But for me, this is not something I’m jumping on – as many screams of a buy that I may come across. I chose not to give into the FOMO.

There’s been numerous examples of FOMO creeping into projects. PAZZY, PAID are names which come up immediately.

Please note FOMO is not a judgement on the project being good, bad or ugly. It’s more about your own position and entry point into a project which may not end up as the wisest of investment choices.

How do I avoid FOMO?

I do a few things,

- I typically stay away from new projects. New listings I mean. (Just a personal choice). New listings typically have people who’ve got in at very cheap prices at internal/private sales. So, there’s a very strong chance of a dump soon after listing. Also the hype at listing time is enormous, because early investors might want to book some profits. Hence, FOMO creeping in is very very easy here. Unfortunately the unknowing smaller investor jumps on board, risking getting hit hard when the bigger investor dumps or sells.

- Do not chase a coin. Nothing moves unidirectionally. Make use of some technical analysis to identify levels. Here are some basics around technicals which can really help get a hang around some entry and exit levels. Besides, if you miss one coin or upmove, there are plenty of others.

- I find this one particularly challenging to follow. But if you can, you’ll do good. Try keeping crypto channels on Twitter, Telegramm YouTube to a minimum. Else the temptations are too many. So many coins being recommended all over. Easy to get affected by the FOMO. In a bull market, these platforms are like the garden of Eden.

- Have a read at these five steps when buying a crypto

I’ll add in some more pointers as I go along.

Hope you liked this content. Feel free to reshare it and do subscribe to the newsletter