So my interest in 1inch is fairly recent, upon realizing I got some of their native coin (1INCH) in an airdrop (this is a marketing activity a project may undertake that involves sending coins or tokens to wallet addresses in order to promote awareness). A pleasant surprise for sure.

Like I said, I didn’t know much about the project, barring the fact that it is a decentralized exchange. I ran a poll on my twitter account to check what to do with it,

And I chose to hold, based on the results.

Been looking into it since and here’s some thoughts:

What is 1inch?

In a recent post, I mentioned centralized and decentralized exchanges. Of course that post was limited to centralized exchanges – the likes of Binance, CoinMetro. 1INCH is a decentralized exchange (DEX), similar to a Uniswap. In fact it goes a step ahead, in that, it is a DEX aggregator.

Let’s understand an aggregator. Why do you shop on, lets say, Amazon? Convenient? Helps you see and compare different prices to a product on one platform so you can choose what works best for you. Instead an alternative option would involve having to scout different platforms and compare stuff. A bit more of a tiresome effort.

In a similar manner, 1inch connects several DEX’s into one platform. This allows users to find the most efficient swapping routes (in terms of cost) across all platforms. So a DEX aggregator, like 1inch, eliminates the need for manually checking, bringing efficiency to swapping on DEXs.

I’ll cover Decentralized exchanges and their use in another post. Keeping it simple here for now.

Who’s behind 1inch?

1inch was founded by Sergej Kunz and Anton Bukov in 2019.

Sergej Kunz started to study programming while he was teen. He has a professional experience of around 15 years of software engineering, architecture and security. More recently, before 1inch, he was working for Porsche

Anton Bukov has been involved in software development since 2002 and has been working on DeFi since 2017.

The project’s been backed by some big funds and investors including: Pantera Capital, ParaFi Capital, Spark Capital, Blockchain Capital, Josh Hannah, Kain Warwick and Alexander Pack.

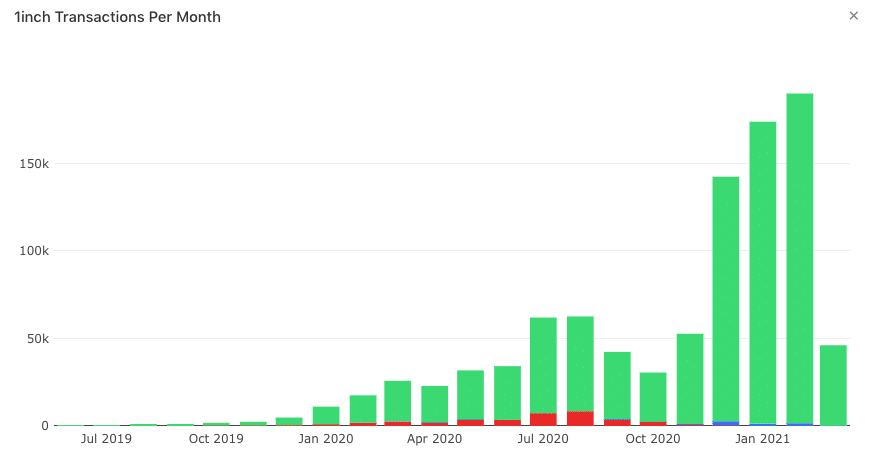

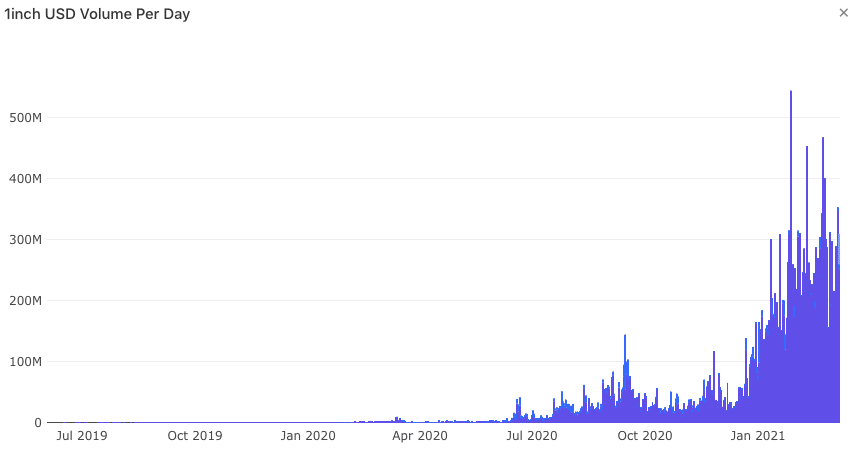

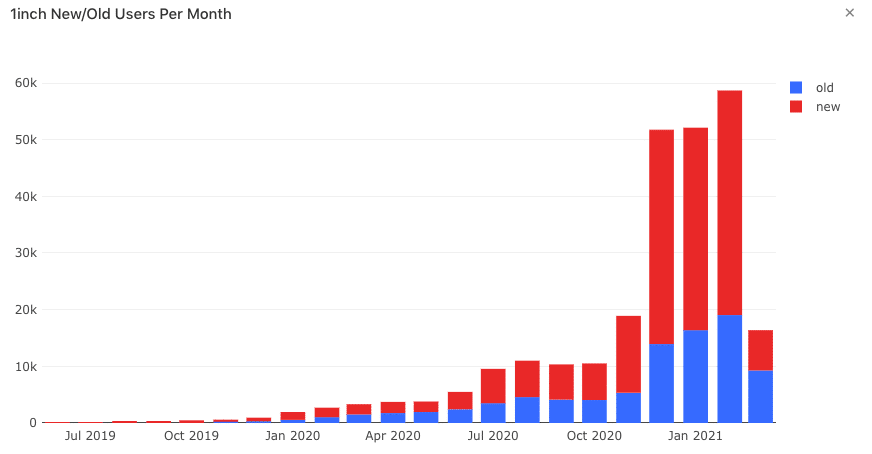

How’d it been growing?

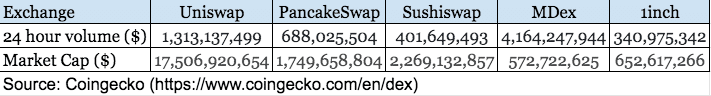

Check this out for some of the latest statistics on this project. I’m listing down a few which caught my eye here,

Bottomline. It’s growing, and growing amazingly well.

Where do I see it go?

Now I know this is a DEX aggregator and Uniswap is a DEX, and given that I guess this will be at some kind of discount compared to Uniswap. But the current valuations seen unfair to me, and I think 1inch can do an amazing catch-up game from here. So ya, within DEX it is the horse I’d bet on.

Here’s a tweet I put out recently to explain my stand,

$UNI or #1inch$UNI

— Making Crypto Easy (@cryptographynow) March 8, 2021

24 hour volume: $1,143,515,185

Market cap: $17.3 billion#1INCH

24 hour volume: $383,073,963

Market cap: $626 M

3 times the volume; 26 times the market cap

I guess @1inchExchange makes more sense

Thoughts? Which makes a better investment here

Explaining this:

I’ll stick to 1inch and Uniswap here. So as you see, Uniswap does approximately 4 times the daily volume (again this is just based on the last 24 hours. The intent being only to provide an indicative idea) of 1inch.

What about the market cap? Uniswap is valued at $17.5 billion, while 1inch is valued at $652 million. So Uniswap is 27 times the value of 1inch. Like I said there can be justifications about Uniswap having a first player advantage and stuff. Agreed and point taken.

But the 27 times difference in value seems like an opportunity to me. An opportunity for 1inch to cover and narrow the gap.

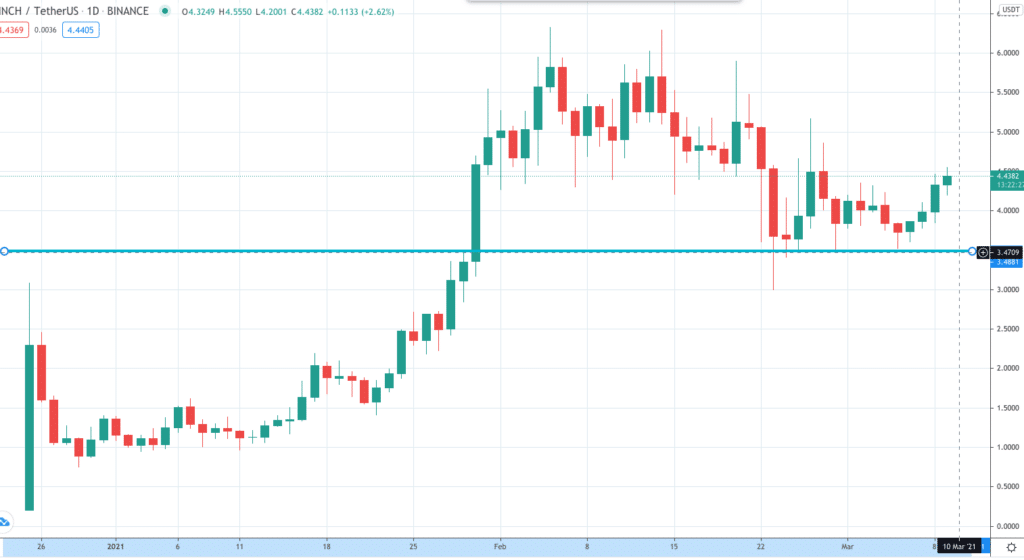

A look at the chart. Not too much of a history here,

Taking decent support around the $3.5 levels. Given supportive over all market conditions, I’d expect this to see a nice nice run this year. A 10X wouldn’t be too much of an ask I feel.

Again do your own research. Don’t just ape into something blindly.