Have to begin off by crediting data shared by Nicholas, creator of The Atomic Project, around this topic. He had some insightful thoughts there which got me to delve into this.

So, I was speaking to a friend the other day and he just told me that his brother, who has recently got acquainted with cryptocurrencies, was excited about his new purchase.

He had just purchased,

“10 million coins of Hoge Finance”

That’s a lot of coins right? At the current price $0.00014964, that amounts to about $1500.

He’s hoping Hoge Finance follows the path of Bitcoin. In that case his, 10 million coins will be worth,

$570,180,000,000

Unfortunately for him, this is probably never going to happen.

Here’s why it is important to be acquainted with the concept of Tokenomics. Won’t get into too many details here but sticking to the one element on this – Supply of coins.

Simply put, tokenomics is the “economics of tokens” or basically anything that impacts the value of the token. This could be utility, team, number of coins, etc.

What I’m focussing on here is the supply of a coin or “How many coins exist? How many can exist?”. This is easily available on the page to a specific coin on Coingecko or Coinmarketcap.

Let’s compare Bitcoin’s supply to that of Hoge Finance,

Bitcoin has a maximum supply of 21,000,000 coins

Hoge Finance has a maximum supply of 1,000,000,000,000 coins.

Consider this. There’s an apple. You cut it into two slices. Then you cut each of those two slices into four. So basically that apple’s now been cut into 8 pieces. Are those eight pieces worth more than the one piece?

Support the market price of that apple is $8. The value of each of those eight pieces is worth $1. Someone smart may sell them for $2 each. However, over a period of time, the market play (demand and supply) will equate the price of those pieces to the price of the whole apple. Not everyone wants their apple in pieces.

Like this content, consider subscribing to the monthly newsletter. Promise it isn’t spam.

Coming back, all that the billions and quadrillions of the specific coin may do is make the token price seem cheap. Like that of Hoge Finance. It may seem like you’re on your way to financial freedom when you purchase a million, 10 million or even a billion of a certain coin, but that may not be the case. Especially not if you’re expecting the price of this to touch that of Bitcoin. This is because of the price and supply dynamics.

It’s simple. More of something, less the demand, lower the price. Less of something, more the demand, higher the price. Think of supply and price on a see-saw.

This is no judgement obviously on Hoge Finance. I’ve not looked at the project. It’s only meant to taper down expectations, that if the price of a coin is very low in dollar terms (not valuations), or you’ve purchased an incredibly large amount of coins, it is underpriced and bound to go up.

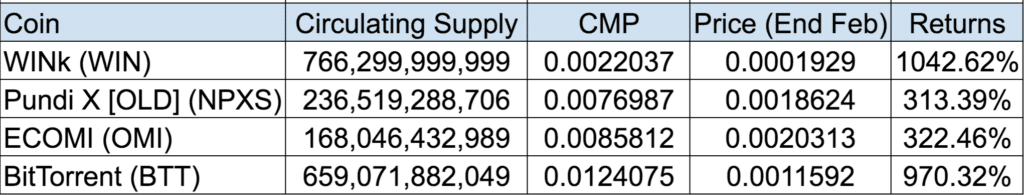

Here’s a look at how some of these low priced coins have performed in March,

Is this a red flag? It’s worth comparing this trend to one from a previous bull cycle. Here’s a look at a couple of such lower-priced coins from 2017-18,

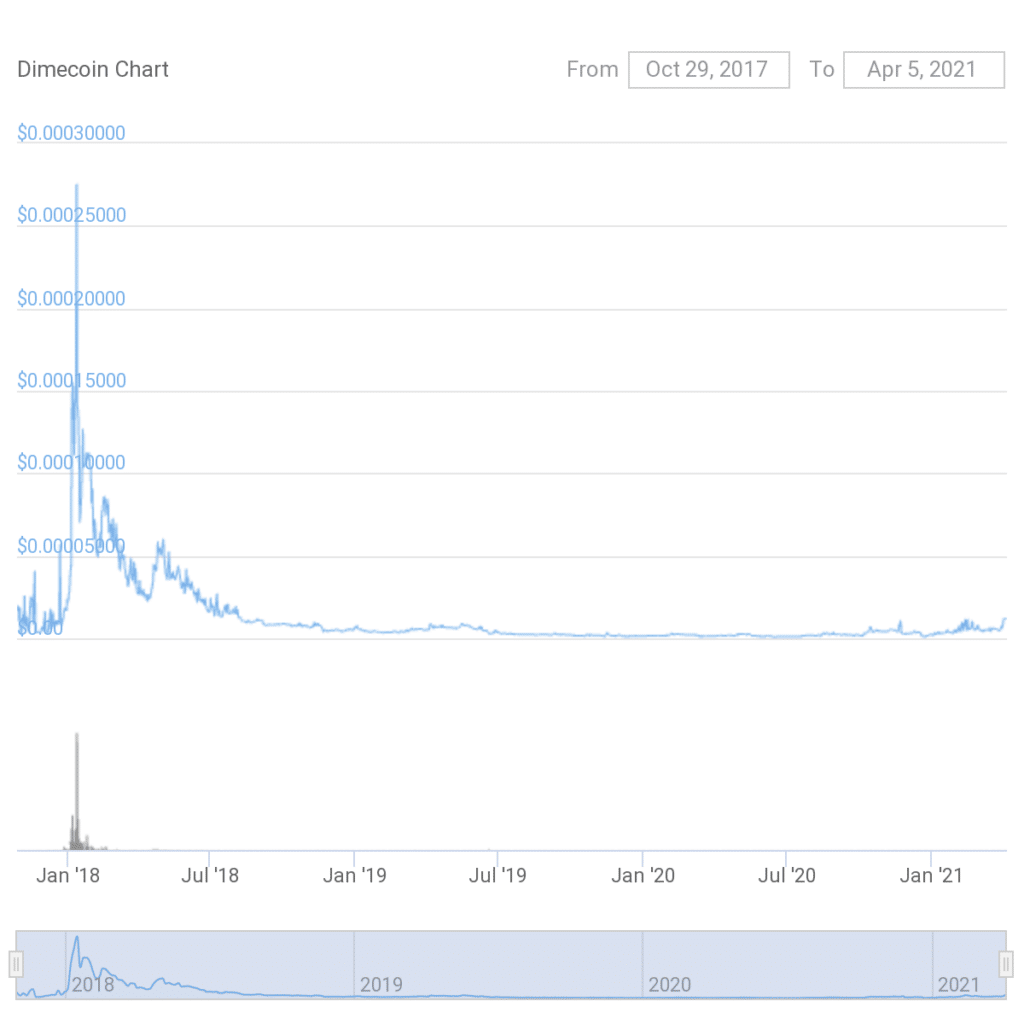

Here’s Dimecoin (Max supply: 539,000,000,000)

Ran from $0.000023 on 31st Dec 2017 to $0.00027 on 12th Jan, 2018, a return of 1073%. Ethereum in the same period went from $774 to $1315, a return of 69%.

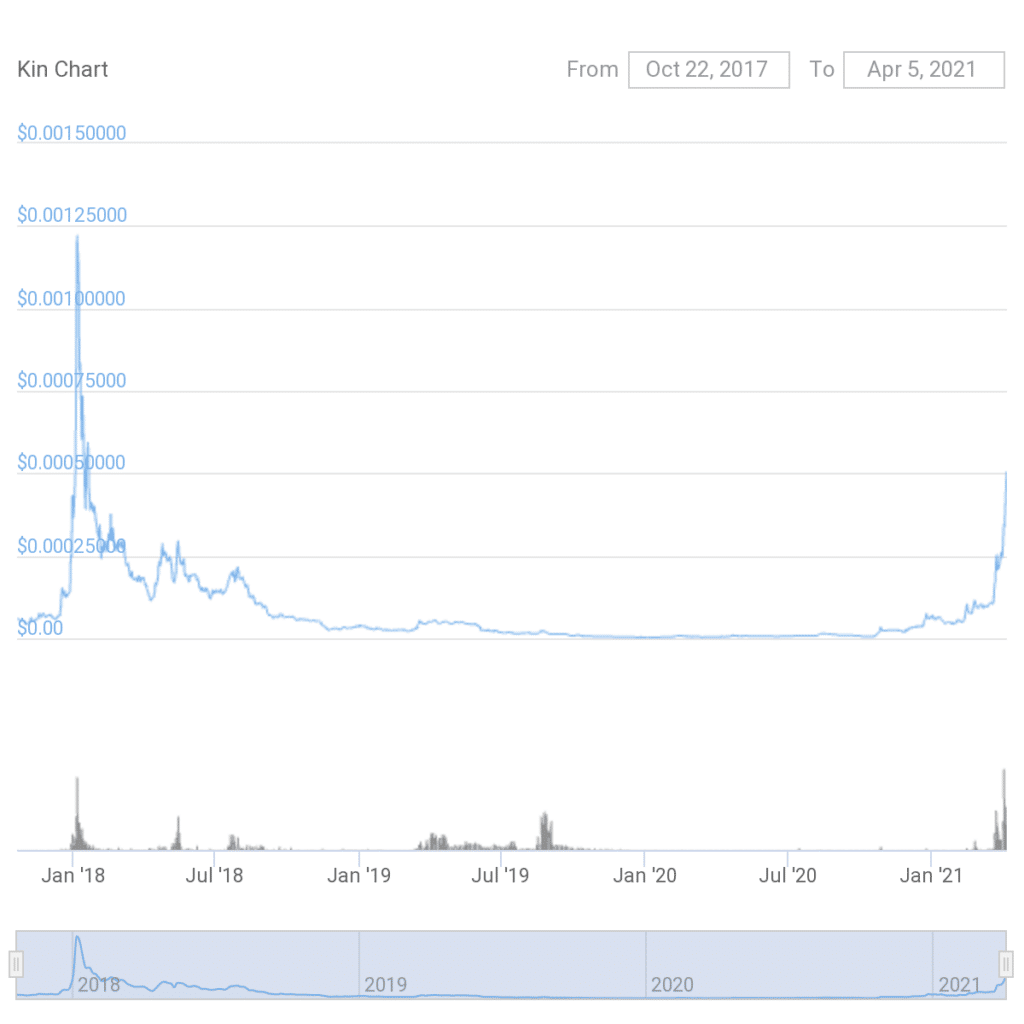

Here’s Kin (Max Supply: 10,000,000,000,000)

Ran from $0.000435 on 31st Dec 2017 to $0.00122 on 6th Jan, 2018. A return of 180% in 6 days.

Again the intent here is not to cast any judgement on these projects. It’s only to inform that comparing prices, without a look at the supply of coins, may not be the right thing to do and you may in fact be comparing apples to oranges.

If you’re new to crypto, just try avoiding getting carried away with low priced coins. It’s very easy to believe that holding a large number of such low-priced coins can lead to incredible gains. That’s not true. Yes, phases within the bull market can trigger moves in such coins, insane moves, but the move will be insane on the downside too. So tread with caution.

It may not be too far fetched that low priced coins do a run-up typically at the latter part of a bull run.

Anyways, amazing stuff if you’ve made money off these trades. You’ve clearly done a cool job reading the trend. But remember to take profits. Expecting one of these coins to move to the levels of Bitcoin may be a tad too much.

For a perspective, if Hoge Finance rises to the level of Bitcoin’s current price, Hoge would be worth

$57,162,870,000,000,000

Whatever that number is!!!! To make it easier, Amazon is worth,