Ok. So at the time of writing, the crypto markets are soaring. Bitcoin is an at all-time high, as is Ethereum and scores of other coins. Will this continue? Will there be a correction? Is this a right to enter the markets? What if I buy and the markets tank? This post aims to present some options when it comes to investing. If you’re new to investing, cryptocurrencies or any asset class for that matter, read along. This could help.

Getting in. Let’s say you’ve decided that you can invest $1200 in cryptocurrencies. You now have two options of investing,

- Lumpsum investing, where you basically put all of the $1200 in now

- Systematic investing, also known as a systematic investment plan (SIP), where you basically spread out that $1200 over a period of time. So, for example, if you decide to spread that out over the next 12 months, that would mean you invest $100 every month. Decide to spread it out over the next 6 months, you’re investing $200 per month.

Now each of these has its merits and demerits. But before that, let’s have a look at how these strategies would play out, with some past data.

Going back a little in the past. Let’s say we are in December 2018. Alex and Becky decide to invest in Ethereum. Each of them has got $1200 to invest. Alex decides to go all in and buys $1200 worth of Ethereum on the 31st December 2018. Becky decides to buy $100 worth of Ethereum on the last trading day of each of the 12 months of 2019.

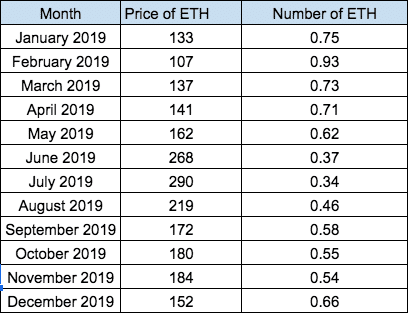

So, at the price of $113.3 on 31st December 2018, Alex has purchased 10.6 Ethereum. Here’s how Becky’s purchases over 2019 would look,

At the end of 2019, she’d have accumulated 7.25 Ethereum.

Well Alex was clearly smarter, and a lumpsum strategy worked better, since he got a lot more Ethereum. Right? Wrong. This happened because the market was trending higher. So it’s not a blanket rule.

Let’s go back a little in history, and repeat the same exercise around the peak of the previous cycle – January 2018, when the interest in crypto was at a crazy peak.

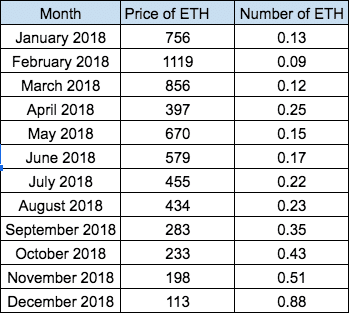

Alex purchases $1200 worth of Ethereum on 31st January 2018 at an average price of $756. So he gets 1.59 Ethereum. Becky spreads her investments between January 2018 and December 2018,

At the end of 2018, she’d have accumulated 3.53 Ethereum. Which is better now? Investing systematically allowed Becky the chance to buy Ethereum at way lower prices.

Again, there’s no right or wrong here. Here are some quick takes on each of these,

Lumpsum investing

- An element of timing the market is involved here

- More of an active investing strategy

- In an up-trending market, can look good in hindsight cause you probably bought at a lower price

Systematic investing

- Not really timing the market here, so you’re participating in ups and downs

- More of a passive investment strategy

- In a down-trending or sideways markets, there’s a chance you’re probably getting an opportunity to buy at market dips, making your buying price lower

I know Coinbase has an option of systematic investing, allowing you to buy at set intervals like weekly, monthly and stuff. You can use this link to create an account if you don’t already have one.

Personal view: For someone starting off, it might make sense to opt for systematic investing. Decide an amount you can afford to put in every month, week or whatever. You don’t need to then worry about buying at the top or when to buy. It can be a smart way to go.

Also, remember you don’t really need thousands of dollars to make a fortune. Staying disciplined and investing even small amounts monthly could accumulate to quite a bit over a period of time.

Fun fact: Investing just $10 every month in Ethereum between 2017 and 2020, a period of 4 years, would mean you’d have invested $480. You’d have accumulated a total of 5 Ethereum, currently worth $11750. So there’s no need of getting carried away, going overboard, leveraging yourself in trying to make a fortune. Unless you’re well versed with doing that. In that case, you should not be reading this. Stay disciplined, invest an amount that works well with you, one which does not cause sleepless nights, or jeopardizes your finances and you be fine. Remember, cryptocurrencies is a risky asset class. So invest accordingly.